|

|

|

|

A Review of Competition Issues In Real Estate Sector: An Analysis of Post Position DLF case

This paper seeks to revisit the competition issues in the real estate sector in India, after the DLF Order -

|

| which has been hailed as “landmark” by many write Shobhit Ahuja and Nakul Bajpai. The scope of the project is restricted to the housing industry. It analyses the consumers’ position and also the industry position and the proposed changes in the law governing the real estate sector. |

|

| |

|

| |

I. Overview of The Real Estate Sector in India

The Indian Real Estate industry grew at a rate of 20% per annum in the five-year period prior to 2010 to become the second highest employment provider after agriculture.1 The real estate sector in any country plays a significant role in shaping the infrastructure. The importance of the sector can be noted by the fact that a HUDCO-IIM, Ahmedabad study recently observed that for every Rupee invested in this sector, the addition to the GDP of the State is 78 Paise. Residential real estate is witnessing a continuous growth due to various factors like growth of population, migration, growth in income etc.

The real estate sector in India suffers from inherent entry barriers. Initially acquiring land is a difficult task for developers and even after that a number of issues like litigation, court orders and cancellation of allotment of land are faced by the builders.

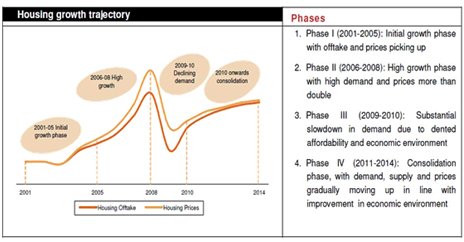

Source: CRISIL Indian Real Estate Overview

a. Regulation of The Sector

The Indian Real Estate Sector is widely unregulated. Though there is some regulation in the form of the various approvals mandated by the law for the developers, there is specifically no regulator for the sector. According to a study carried out by FICCI and E&Y: “On theRegulatory index amongst the countries surveyed India ranked last along with Russia amongst ten countries surveyed namely - China; US; UK; Singapore; Germany; Brazil; UAE; Russia; and India. Due to their developed real estate markets and streamlined regulatory environment, developed nations such as the US, UK and the Singapore closely follow China on the index. India ranks fifth on the overall index, as it scores better on the country economy development index and the real estate market index, but fairly low on the regulatory index. In developed countries, the regulatory framework is typically well-established, organized and transparent. As such, the regulatory environment in such countries serves as an effective watchdog. In contrast, the regulatory scenario in developing nations is at a nascent stage. Consequently, developed countries lead the regulatory index.” The need for a regulator in the real estate sector has been said to be more than that of a regulator of stock exchange since real estate per se affects more consumers.

b. The Draft Real Estate (Regulation and Development) Bill, 2011

The Real Estate Bill is a novel step and has the potential to curb the menace that has ensued in the Real Estate Sector in the recent times, if proper implementation is ensured. The Bill seeks to establish the Real Estate Regulatory Authority to see that the real estate sector functions properly. It contains provisions for disclosures by developers on the estimated time by which they will complete the projects, compulsory uploading of the proforma Builder Buyer agreements on the Regulatory Authorities’ website, online declaration of all project details. There are various other provisions like equal rate of interest payable by the developer

1. http://www.icmrindia.org/casestudies/catalogue/Business%20E

thics/DLF%20and%20Indian%

20Real%20Estate%20Industry-Case%20Study.htm

2. V Raghunathan, “Home buyer at the mercy”, Moneylife, September 6, 2012.

and the buyer in case of any default, prohibition of false and misleading advertisement, undertaking of clear title over land. It also provides that the real estate developer shall be required to deposit at least 70% of the funds received from end customers into a dedicated project account, which can be utilised only for the purposes of the project. No advance can be taken from the buyers before first entering into an agreement with them. To check delays, registration can be extended only up to two years beyond the original period for development granted by the local licencing authority. The Bill also seeks to have proper coordination with the Competition Commission of India (CCI) by providing in its Section 33 that if any issue comes up before the Regulatory Authority relating to an “agreement, action, omission, practice or procedure” which can lead to “prevention, restriction or distortion” of competition in the real estate sector, it may refer the matter to the CCI.

It has been held by the Commission that sectoral regulators focus on the dynamics of specific sectors, whereas the CCI has a holistic approach and focuses on functioning of the markets through increasing efficiency through competition. In fact their roles are complementary and to each other and share the objective of obtaining maximum benefit for the consumers.

II. ABUSE OF DOMINANCE IN THE REAL ESTATE INDUSTRY

a. Relevant Market

The foremost issue in any abuse of dominance case is defining the “relevant market”. This is important since dominance, if any, is assessed and analysed only in the perspective of the relevant market. The relevant market comprises of the relevant product market and the relevant geographical market. The attempt of the person bringing forward a case to the CCI is always to define the relevant market in the narrowest possible manner while the Opposite Party always tries to define it in a wide manner. It is on the CCI to view the situation and decide what should be the relevant market, a decision that sometimes becomes very controversial.

Relevant Product Market:It consists of the smallest set of close substitutes. Substitutabilityis seen from the demand side as well as the supply side, that is, the products which a consumer

3. Shri Neeraj Malhotra v. North Delhi Power Limited, BSES Rajdhani Power Limited and BSES Yamuna Power Limited, Case No. 06/2009

would find substitutable and those which the producer can shift to given his existing facilities.

Relevant Geographical Market: It is the market wherein the conditions of competition arefairly homogenous. For determining the relevant geographical market, various factors have to be taken into consideration like: shipping costs, local specification requirement, regulatory trade barriers, adequate distribution facilities, transport costs, language, etc.

b. Assessment of Dominance

It is well settled law that before analyzing whether an enterprise has abused its dominant position, it is paramount to first assess whether the firm is dominant in the relevant market or not. Only if it is dominant does the case for abuse come in. In the Competition Act, 2002, there is no arithmetic criterion that can determine dominance in the market. The erstwhile MRTP Act contained a 25% benchmark for a firm to be called dominant but this was removed on the transformation to the Competition Act. The Act, however, enumerates the various aspects which the Commission has to look into while assessing dominance. Dominance has been said to be a position of strength enjoyed by an enterprise in a relevant market which enables it to operate independently of the competitive forces prevailing in the dominant market or affect its consumers or competitors or the relevant market in its favour.

The various factors given under S. 19(4) are as follows:

i. Market share of enterprise

ii. Size and resources of enterprise

iii. Size and importance of competitors

iv. Commercial advantage of enterprise over competitors

v. Vertical integration

vi. Dependence of consumers

vii. Dominant position as a result of a statue

viii. Entry barriers

ix. Countervailing buying power

x. Market structure and size of market

xi. Social obligations and costs

4. In South Africa, a firm is irrefutably considered to be dominant of its market share exceeds 45%. [Section 7(a) of the Competition Act, 1998]

xii. Contribution to economic development

xiii. Any other factor

It has been observed by the Commission in its order in Poonam Gupta v. Unitech Ltd. case that for an enterprise which has a presence throughout the country, a high Market Capitalization cannot be an indicator to determine its dominance in a particular market since it may have little or no operations in that particular market.

In the case of Informant v. Cdr. Kuldeepak Mittal & Ors , it was held that the Government Officials Welfare Organisation (GOWO) (a Public Trust engaged in the business of developing residential apartments for government officials in Noida and Gurgaon) did not have a dominant position in the relevant market of Gurgaon since it was one of the builders operating in the relevant market and had no definite advantage in terms of market knowledge, economies of scale and experience. It further did not have any significant chunk of land holdings with it in that geographical area.A high market share of a firm is not a factor to conclusively determine that a firm is dominant. It has to be seen in the perspective of the market shares of the competitors in the relevant market. For example, if one firm has a market share of around 45 % and the rest of the market is diffusedly divided among weak players, he may be considered dominant. However, if the rest of the market is divided among key rivals, the doubt of dominance will be reduced.

c. “Abuse” of The Dominance

In the real estate sector, the “abuses” normally complained of are in terms of either unfair and discriminatory terms in the Apartment Buyer Agreement or delays in the possession

d. Unfair Terms of Contract

The Supreme Court of India in the case of Central Inland Water Transport Corporation Ltd.and another v. Brojo Nath Ganguly held that parties to the agreement should be on equalfooting and with same bargaining power. In this context, it may be said that when a flat-buyer enters into an agreement with a builder, the bargaining power is somewhat lacking.

5. Case No. 04/2012, along with Rohit Gupta v. Unitech Ltd, Case No. 05/2012

6. Case No 62/2010

7. Raghavan Committee Report on Competition Law, AKZO Chemie v. Commission (1993) 5 CMLR 215.

8. (1986) 3 SCC 156

There is usually a standard form contract which the buyer has to sign in case he wants to buy the apartment. A contract between a buyer and builder suffers from an innate lack of equal footing. It is a contract between a huge developer and an individual which suffers from information asymmetry. It is a standard one sided agreement containing various unfair terms.

There are some states which themselves regulate the unfair, onerous and one sided agreements between buyers and builders. A suitable example of this is the Maharashtra Ownership of Flats Act, 1963. It has a number of provisions to ensure that the builder is not able to harass the buyer.

e. Delays by builders

According to a report by a property research firm Propequity, nearly half of the 9,30,000 under construction residential units in India, scheduled to be delivered between 2011 and 2013 are likely to be delayed by up to 18 months. According to real estate research firm Liases Foras, nearly half of the 3,23,000 homes that were to be delivered in 2013 will bedelayed; and a third of these won’t be ready before 2015. Developers announced a lot of projects in the pre 2008 crisis time but were unable to complete these due to a funding crunch. The worst performer was NCR with only about 23% of the projects completed by January 2012. The reason for this is said to be that the projects were very large and so the developers were not able to complete them on time. When there are such delays by the builder, the buyer faces huge losses. In a situation when a person buys an apartment in order to save the money he/she has to incur every month on the rents in the current accommodation and there are delays by the builder in handing over possession. The buyer can nowhere see the project being completed for years together. In such a scenario, not only does the buyer have to pay the regular rents but has to also pay the EMI’s for the flat he/she has purchased but not got. The buyer gets fixed in a trap and is unable to get out of it. The perspective of

9. http://beta.propequity.in/PressRoom/Sep13ET_Large.jpg

10. Ravi Teja Sharma & Vijaya Rathore, “Aggreived Buyers Speak Up Online ! Real estate firms resort to online reputation managment on social media”, Economic Times, Nov 28, 2012

11. Varnika Kukreja, “When will I be delivered my house? A big question faced by most of the developing firms in India; which has put a full stop on the dreams and aspirations of an average common man”, Property Observer, June 22. http://beta.propequity.in/PressRoom/June22PO_Large.jpg

12. Namrata Kohli, “DELAY, DEFAULT AND DECEIT: The 3Ds Plaguing The Real Estate Industry, How Should a Buyer Or An Investor Deal With This Triple Malaise”, The Times of India, Sept 29, 2012.

the developers on the delay in the projects is that this delay is due to the multifarious sanctions and approvals that are to be taken by them in respect of all projects. They estimate that these approvals take around 2-3 years and hence propose that there must be a single window clearance with which it is possible to procure the approvals within 4 weeks.

With respect to construction approvals, “Doing Business”, a report by World Bank and International Finance Corporation ranked India at 177 out of 183 countries in 2011 and the position further deteriorated in 2012 at 181 out of 183 countries.

III. Belaire Owner’s Association v. DLF Limited And Huda

a. Contentions of the Informant

The informant (Belaire Owners Association) in this case contended that DLF Ltd had abused its dominant position and inflicted several unfair and arbitrary terms of contract on the apartment allottees of the Group Housing Complex, “the Belaire”. In specific, the informant has pointed out the following points in support of the contention that DLF had abused its dominant position:

- Each of the five multi storied buildings was to originally have 19 floors each with a total of 368 apartments. However ignoring the fact that this was the basis on which the allottees booked their flats, DLF constructed 29 floors in each building.

- DLF had conferred on itself the exclusive right to reject and refuse to execute any Apartment Buyers Agreement without assigning any reason for doing so. It could further carry out any changes in the layout plan for which the consent of the allottee shall not be a necessity and if any amount is liable to be returned in respect of preferential location charges to the allottees on account of such change, it would not be refunded but adjusted in the last installment without any interest.

- Time is made of essence with respect to the payment obligations of the allottee but not the performance of DLF.

13. 2011 CompLR 0239 (CCI)

- In case of failure by DLF to deliver the possession, the allottee is obligated to give a notice to terminate the agreement. DLF is not bound to refund the money but gets the right to sell the apartment and only thereafter repay the amount.

- DLF has unilaterally reserved to itself the right to create any lien or mortgage to raise finances. In case of non-payment, the allottee becomes the direct sufferer.

- The penalties for delay by the respective parties are highly non-commensurate. The allottee is to pay 15% for the first 90 days of delay and 18% after 90 days whereas DLF is obligated only to pay Rs 5 per sq ft for every month of delay (which is 1% p.a)

- Between the date of booking and the date of execution of the ABA, the allotee had already paid amounts to the tune of Rs 85 lakhs without knowledge of the unfair terms that would be included in the ABA. Thereafter, there was delay in taking the necessary approvals by the company and before the construction was even started, DLF had around 33% of the consideration in its pocket.

b. Relevant Market

High End residential accommodation in Gurgaon

c. Contentions of the Opposite Party

DLF contended at length that it is not a Dominant Player in the relevant market. It pointed out that a number of competitors exist in the market and there is stiff competition and further that there are no impediments to the entry of new players. It explained its high turnover with the fact that it has presence in other markets also. It was also contended that the conditions included in the agreement are the “usual practices” adopted by the builders and are part of industry practice. DLF also contended that the allotees had various options in respect of making a choice of buying an apartment and also signed the agreement after considering all the pros and cons in respect of their investment.

d. Order of the Commission

The CCI observed that while assessing dominant position of an enterprise, the sole factor is not the market share of the enterprise in the relevant market but a host of other factors are to be seen which are enumerated in S. 19(4) of the Competition Act, 2002. It analyzed the various factors and came to the conclusion that DLF is dominant in the market of Gurgaon. After looking at the various one sided terms of the agreement and the condition of the consumers in this case, DLF had abused its dominant position.

The following are the sixteen clauses in the Apartment Buyers Agreement which were considered to be unfair by the Commission:

- Unilateral changes in the agreement and the power to supersede and substitute the terms of the agreement with respect to subsequently approved lay out plans without the consent of the apartment allottees;

- DLF’s right to change to layout plan, again without the consent of the apartment allottees;

- Discretion of DLF to use areas owned by the allottees in the compound for other purposes like residential, commercial;

- It was mandatory to pay preferential location charged paid up-front, but when the location was unavailable, the refund would of the amount of his last instalment (without any interest);

- Unilateral right of DLF to increase and decrease super area with consent of allottees who had to bear the price of this right, by being coerced to make additional payments as and when necessary;

- DLF has the right to substitute the method of calculating the proportionate share in ownership of the land beneath the building and/ common area and facilities even though the allottees has already been promised he owns a certain amount of land;

- The allottees have no rights in regard to the community recreational facilities; The current project underway (‘Belaire’) can be linked to another one at the sole discretion of DLF which would alter the ambience and quality of living, which is the main reason that allottees have decided to invest in the project in the first place;

- DLF made it mandatory for the allottee to pay any extra external charges that would arise during the construction;

- Arrangement of the supply of power to the apartments and their rates are in the hands of DLF can be levied as and when desired;

- Arbitrary forfeiture of amounts paid by the allottee as earnest money, brokerage charges etc;

- No exit option for the allottees, in case possession is not handed over and even in that event the money is refunded without interest after the apartment has been sold to someone else. DLF had minimized any loss possible for itself but had maximized losses for the allottee in every situation;

- DLF at any point can abandon the project without any penalty. In case possession is not handed over within three years of the agreement, DLF is liable only to refund the amount paid by the apartment allottee with a simle interest at 9% per annum for the period such amount was lying with DLF. If the project is delayed beyond three years, compensation will be paid at a mere 5%.

- Allottees have no rights relating to alterations of the building;

- Third party rights created to raise finance/loan, which is to the detriment of the allottees without their consent;

- Penalty in case of default of payment for the allottees is at a rate of 15% for the first ninety days after which it would at 18% per annum.

The CCI imposed a penalty of Rs. 630 crores for abusing its dominant position in the relevant market of Gurgaon by imposing unfair conditions in its agreements with the flat buyers. DLF

Gurgaon was ordered to modify such conditions within three months from the date of receipt of the order.

IV. Competition Appellate Tribunal (COMPAT)

The fine imposed by CCI has been stayed by the Competition Appellate Tribunal (COMPAT) on being approached by DLF. The COMPAT has also ordered DLF to submit the draft of the modification to the contentious terms of the agreement within eight weeks.

V. Other Orders Relating To DLF’s Abuse of Dominance

- DLF Park Residents v. DLF Ltd: In this case, while the agreement had been madeon one premise of building 19 floors in each tower, DLF subsequently scrapped the project and started constructing a new project with 29 floors in each tower without

14. Case no. 18 of 2010

informing the buyers. This led to unreasonable delay in the completion of the project. Since the contravention committed by DLF in this case was similar to that in BelaireOwners’ Association v. DLF and hence no separate penalty was imposed on DLF.

- M/s Magnolia Flat Owners Association & Others. v. M/s. DLF Universal Limited & Others: In this case, after the payment of 90 percent of the sale consideration by thebuyers, DLF wanted to change the building plan thereby increasing the number of floors. The agreement also contained various one-sided clauses. DLF was ordered to cease and desist from imposing such unfair conditions and to suitably modify the terms of the agreement within three months.

VI. Implications of The DLF Order

a. For Real Estate Players

The order of the CCI has wide implications for the other real estate players in the market. The former DG at CCI remarked that the order will send “strong signals to the real estate market”. DLF in its contentions had alleged that the practices adopted by it are part of industry practice and are followed by all the builders in the market. Several other builders also have similar clauses in their agreements with their flat buyers. The CCI, in its order has also urged various state governments and the central government to come out with real estate regulations to ensure that the consumers do not suffer in the hands of such one sided agreements and other practices which are detrimental to the interests of the consumers as a whole. For DLF itself, the “cease and desist” order could prove a hurdle in launch of new projects. Though the penalty has been stayed by the COMPAT, the same is not true for the “cease and desist” order. Hence it is quite possible that DLF will not be able to launch new projects using the same agreements.

This order is significant in the sense that it is the first instance in India where competition law has covered the “exploitative” nature of abuse of dominant position. The jurisprudence earlier relied mainly on “exclusionary” abuses like predatory pricing or refusal to deal

15. Dilasha Seth, “Amid calls for fairer buyer pacts, DLF launches in face of CCI order”, Business Standard, Dec 06, 2012.

etc. Exploitative abuse takes within its ambit those behavior patterns on the part of firms which have a direct detrimental effect on consumers. Hence it should be a precedent for the real estate companies who must now themselves try to ensure that they so not face any similar situation in their future.

b. For Consumers

The order in the DLF case has been hailed by a number of consumers who have faced similar harassments in the hands of the builders as faced by the informants in that case. Many of those consumers have also approached the CCI with similar claims of abuse of dominant position. Buying a home is the biggest financial investment of a person’s life and hence it becomes very disappointing when there are delays or unfair practices in that.

c. Consumers Dilemma post DLF Order

It has been seen that after the passing of the DLF order imposing penalty, a series of 200 complaint letters have been received by the Competition Commission of India in relation to similar claims, 15 of which were official cases17. It has been alleged that several other builders have also adopted similar practices as those adopted by DLF and similar “unfair” agreements made by them.

The crucial point to be seen in this regard is the overlapping of the jurisdictions of the CCI and consumer forums.18 Mostly, the allegations that the Apartment buyers are putting forward are in the nature of mere consumer disputes. Though the preamble of the Competition Act, 2002 reads in its ambit the protection of consumers interest also, it cannot overtake the role of the consumer forums. Many consumers have regarded the DLF judgment as their protector and have approached the CCI. It is further pertinent to point out that the abuse of dominant position provisions can be applied against an enterprise only when it is first dominant. It is due to these reasons that in a majority of cases the CCI has held that there is no prima facie case and left the option open to the consumers to approach an appropriate forum.

Mr Vinod Dhall, former acting Chairman of CCI said in relation to the order: “Real estate

16. MM Sharma and Vaibhav Choukse, “Impact of Competition Law on Indian Real Estate Sector: An analysis of Order against DLF”, 2012 CompLR B-111.

sector was waiting to get some kind of discipline…But this does not mean that CCI has become a consumer court. Both have different roles. CCI’s role comes in only where competition is affected.”19 The consumers approach the CCI in regard to practices of the developers. However, CCI can only take up a case when it affects competition in the market, that is to say CCI’s eyes are to see malpractices in the market and not to do justice in regard to individual consumer cases. Considering this point in mind, the CCI has dismissed a number of cases regarding real estate developers since there was no competition issue in those cases.

VII. Conclusion and Recommendations

a. On the Indian Real Estate Sector in general

The real estate sector in India is plagued by the requirement of around 52 approvals for every project that is proposed to be undertaken by them. This leads to a time period of two to three years differing from state to state. In such a scenario, it is a major concern that even though the Real Estate Bill makes promising provisions, it will just be another “approval requirement” for the developers.

Among industry players, when asked about the provision of the Bill they found most regressive, 47% opted for mandatory registration of each project with the Real Estate Regulatory Authority. The other opinions were as follows:

- 20% said it was the requirement to keep 70% of the amount realized in a project in a separate account and use it only for the purposes of the said project

- 17% said that the most regressive provision was the prohibition from receiving any advance without first entering into an agreement with the buyer.

- 15% opted for the provision that maximum two years extension can be provided after the expiry of the initial period of completion of the project.

Considering these points, it is recommended that there should be attempts made to reduce the amount of approvals required to be taken by the developers. Developers have time and again

17. Realty Decoded, FICCI-E&Y Indian Real Estate Report 2010.

18. Emerging Trends in Real Estate, Grant Thornton-CII Report 2012.

brought forward the demand for single window clearance in the sector. If the Real Estate Regulatory Authority cannot be made a single window clearance immediately, attempts should be made towards that direction and to see that this Authority does not end up becoming another “approval” for the developers. Again, as regards competition, the Authority must ensure proper coordination with the CCI and the two bodies must work together to improve the face of the Indian Real Estate Industry.

b. On the role of Builders Associations

CREDAI must embark on the responsibility of ensuring that the developers do not try to become larger than the competitive forces in the market. Specifically after a case like DLF has come before everyone, it is expected that the association must take a proactive step to ensure the code of conduct laid down by it is followed and any violations should be seen strictly. Further, specific guidelines to ensure competitiveness in the real estate market are the need of the hour. International practices in this regard should be taken into consideration and best practices should be adopted by the associations in India. It must also undertake monitoring of the competition compliances by the firms under its ambit.

c. On practices in the real estate sector

The practices in the real estate sector relating to the practice of making standard form contracts containing unfair and discriminatory terms should be checked so that competition in the market is not harmed. Delays in the projects and changes in the layout without the consent of the buyer should be also checked. It is hoped that most of the concerns will come to an end when the Real Estate Regulator is brought in and starts functioning.

d. On the role of the Competition Commission of India

The CCI must now play a role in looking into the agreements entered into by various developers with their customers. There is a possibility of inquiring into the practices from the perspective of cartelization. The conditions of purchase that various developers put forward are similar in nature. If collusion in the same is proved, it can become a very good case for CCI to look into and impose penalties if any violation is found.

19. “CREDAI code of conduct to ensure transparency”, The Hindu, June 18, 2011.

|

| |

| SHOBHIT AHUJA & NAKUL BAJPAI are students pursing B.A. LL.B (Hons.) from National Law University, Orissa. They may be contacted at 13ba042@nluo.ac.in. |

|

|